See how Portals from EIS help insurers make all parts of the insurance lifecycle (from buying to quoting to claims) more efficient and pain-free for all uses.

All insurance technology providers seem to say the same thing: speed, agility, scale, cloud… you get the picture.

So for smart insurers with big ambitions, the work of choosing the best technology for your company is all about reading between the lines. It isn’t about what a core system partner can promise — it’s how their architecture delivers on that promise that makes all the difference.

For example:

If you scale a platform that isn’t modular… you can still scale it, but it’s really expensive.

If you have an open system, but creating a new integration means complex hard-coding work, how “open” is it really?

If you say it’s easy to launch products, but customizations or geographical expansions take exorbitant amounts of time, is quick time to market truly a value proposition?

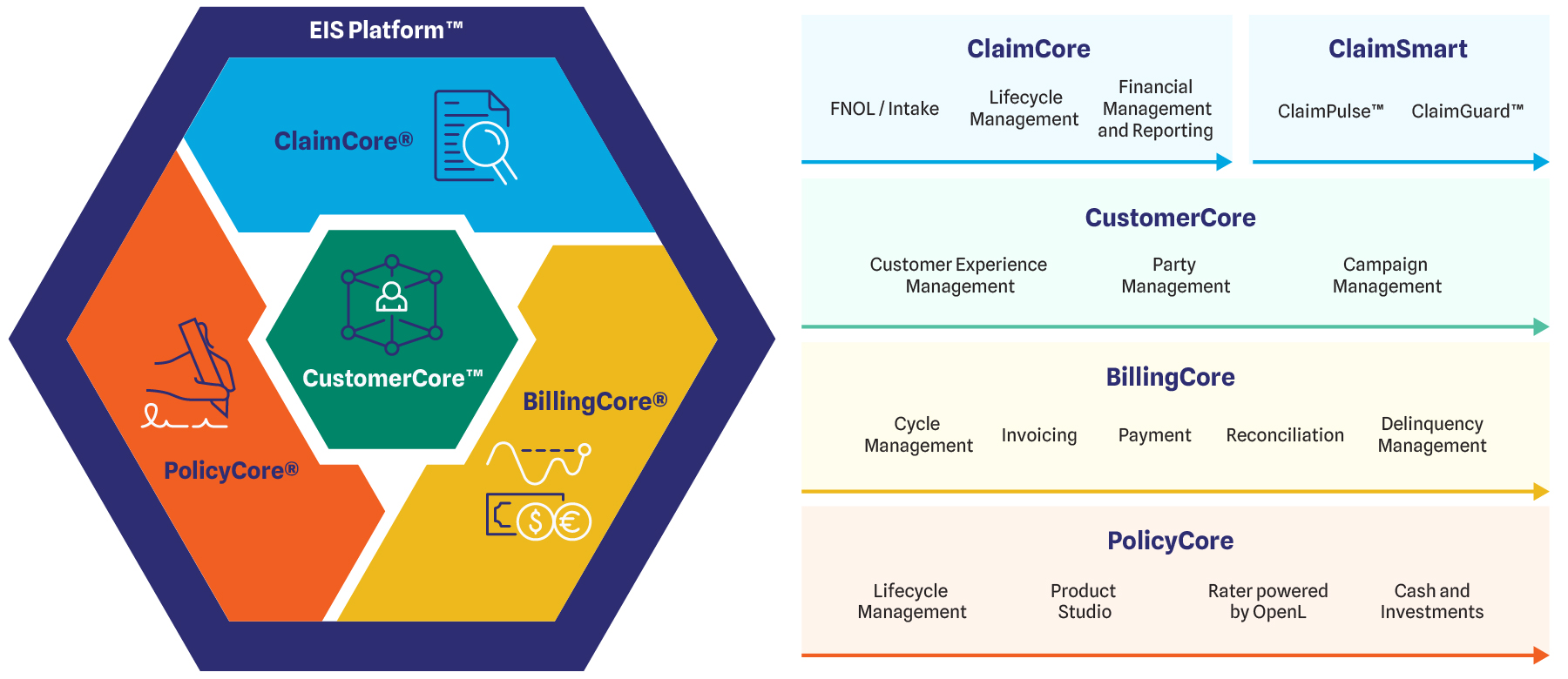

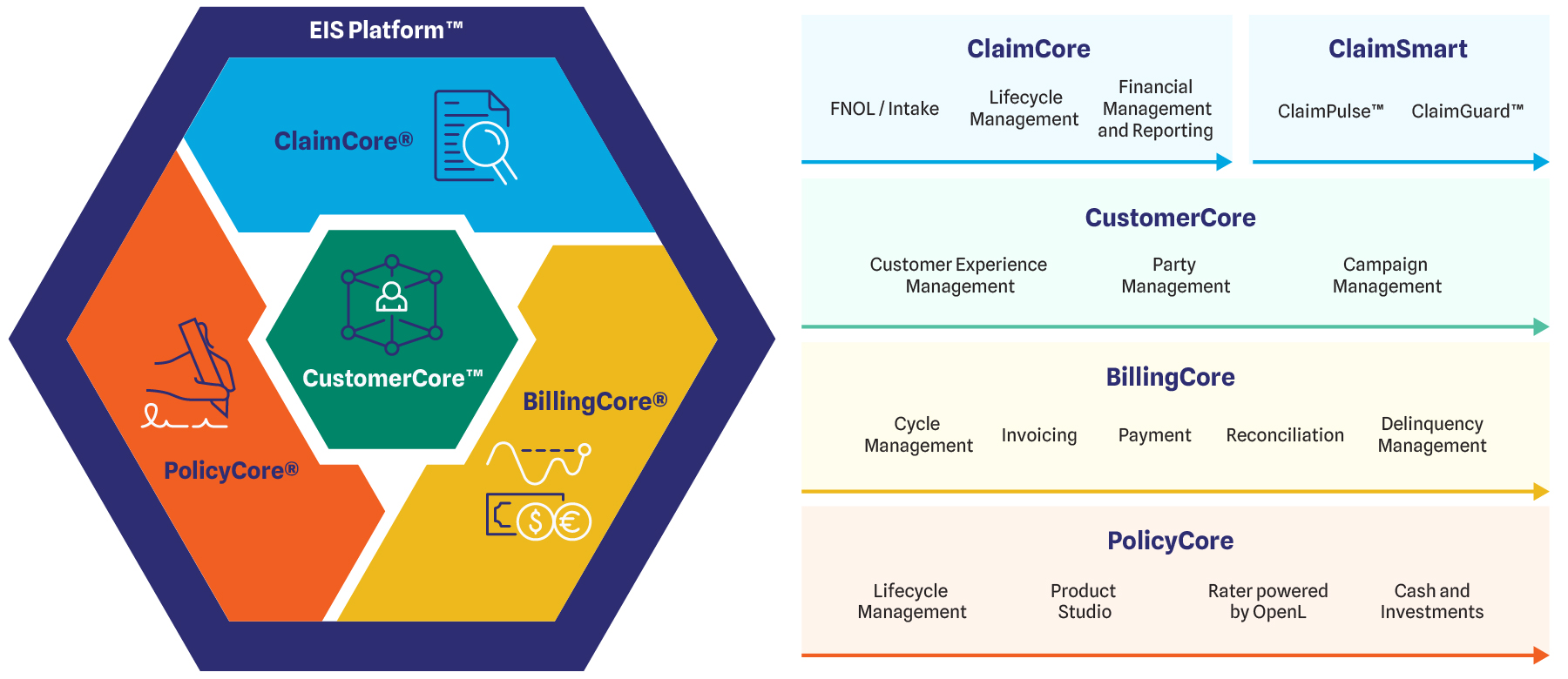

With EIS Platform™ as our base, and CustomerCore™ our central record-keeper, everything involved in policy administration, billing management, and claims management integrates seamlessly and efficiently into one cohesive customer-centric experience for both the customer and the insurer. Our open, API-rich, event-driven architecture helps you do things that insurers of the past could only dream of.

Watch our video about how the fictional Galaxias Insurance took advantage of superior architecture to future-proof their business model:

(Hover over image for more details)

Built on MACH architecture principles, EIS Platform disposes of the clunky insurance technology setups of yesteryear, eliminates data silos, and gives you an open, event-driven operational hub.

Streamlining claims is one thing, but using AI and machine learning to find even smarter efficiencies and drastically reduce fraud is another. Whether you need a new claims management system or are looking for a solution to operate on top of your current setup, we’ve got the perfect solution for you.

Our answer to complex policy lifecycles, inefficiencies, and increasing policy administration costs, PolicyCore gives you real-time responsiveness to quickly adapt to customer needs and changing regulatory requirements.

Get efficient and flexible billing management to automate critical financial phases like invoicing, payment processing, delinquency, reconciliation, and more with incredible accuracy.

Because EIS Suite™ can support operations for all lines of insurance, the opportunity for consolidation and reducing IT costs is off the charts. (Not to mention all the loyalty-boosting and cross-selling opportunities it enables for larger insurance companies with multiple products to sell.)