See how Portals from EIS help insurers make all parts of the insurance lifecycle (from buying to quoting to claims) more efficient and pain-free for all uses.

Together with CustomerCore™, EIS Platform™ empowers carriers to provide intuitive, highly personalized customer experiences and streamlined operations.

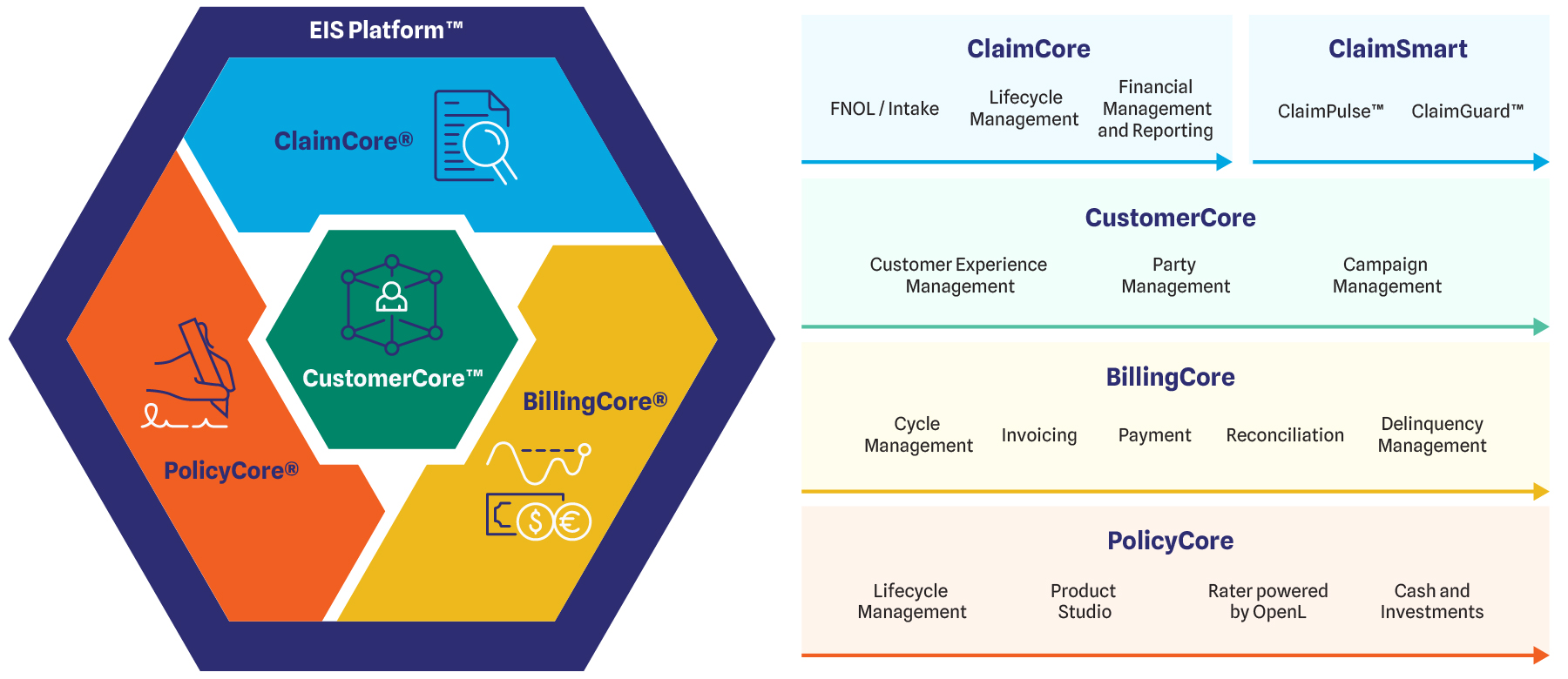

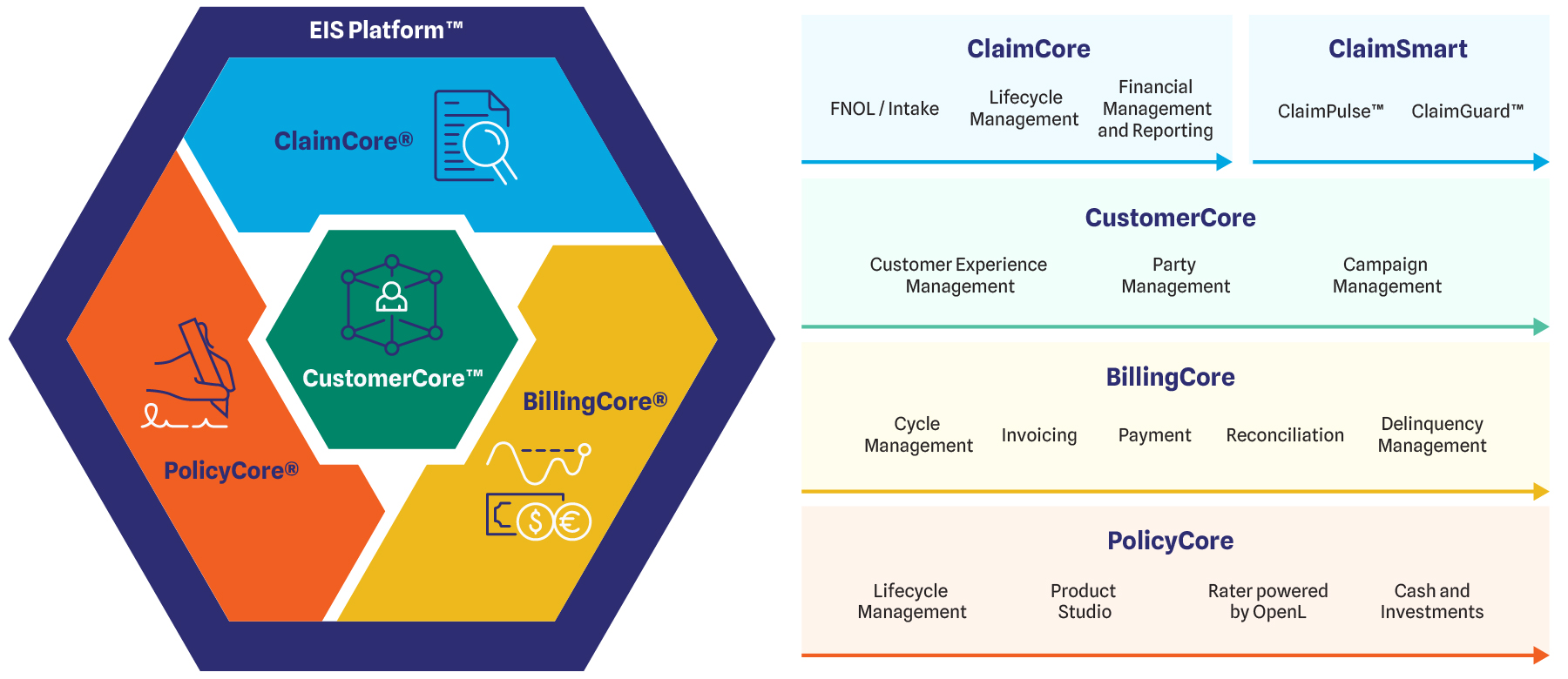

Built on open, event-driven, and real-time-responsive SaaS architecture, EIS Platform (the heart of EIS Suite™) enables complete control of critical insurance processes across all lines of business. This boosts efficiency and improves product offers without sacrificing customer-centricity. The platform integrates easily with all major cloud deployments, databases, and coretech (whether EIS or third-party) solutions.

CustomerCore unifies this data to provide a panoramic view of all customer timelines across the entire insurance lifecycle. With this data-driven foundation, carriers can develop, manage, and automate business rules, workflows, user portals, and security compliance to improve customer experience and operational efficiency.

EIS Suite is built differently from the insurance technology models of yester-year. Instead of centering data and records around policies sold, the data and architecture are centered around the customer, with billing, policy, and claims acting as seamless supporting characters.

Our customer-centric, event-driven, open, and API-rich architecture enables the kind of efficiency and personalization modern legacy systems just can’t offer… let alone deploy quickly. With EIS, you’ll be set up for decades of future-proof business operations.

(Hover over image for more details)

EIS Platform provides insurers the pre-made components necessary to create responsive UI for every user persona. Develop critical applications and components for insurance products without getting bogged down in coding, and accelerate time-to-market while strengthening customer satisfaction.

This EIS Platform component enables both business and technical users to build and manage workflows for key business processes. Create event-driven workflows that allow you to make informed decisions, and use the drag-and-drop interface to manage and adjust processes.

Put operational data to work like never before, generating comprehensive, insight-rich reports based on relevant parameters. Business Activity Monitoring tracks all user activity in EIS Suite, and stores it in records that can be used for effective reporting.

From that data, you can deploy on of our more than 80 pre-built report templates, or export that data to third-party analytics solutions.

CustomerCore provides the perfect combination of data visibility and structure that insurers need to truly understand and more effectively serve their customers. Customer Experience Management allows carriers to quickly view customer histories (claims, financial transactions, etc.) and receive real-time updates to shape CX based on client needs.

Launch portals for each user type in your value chain, tailored to meet their distinct information access and workflow needs. Unique portals include insureds, brokers, agents, vendors, support staff, claims agents, and self-service policy shopping, among many others. EIS portals are designed as adaptive web applications that work alone or integrated into your existing client portal.

Group insurance carriers can leverage even more from CustomerCore with these enhancements (hover to read more):

“We’re on a mission to transform our business into a world-class digital insurer, and to disrupt the insurance industry. The flexible EIS platform will help us leapfrog the competition by providing a tech enabled customer experience, tailored propositions and attractive pricing. Our strategic partnership with EIS is an exciting and significant milestone on our digital transformation journey.”

David McMillan, CEO of esure

Our event-driven SaaS architecture helps insurers improve customer experiences and increase market share through loyalty, customization, and ease of use. Using these tools as the core of your system optimizes process efficiency while enabling a whole new level of customer-centricity.

Build fully or partially automated workflows with clearly defined sequences of tasks on EIS Platform. They’re triggered the moment a customer or agent reports a claim — or the instant a data change is picked up from one of your internal or external data sources. The system also ensures data is readily accessible to personnel and tools that need it while remaining secure and private per regional regulations.

EIS Platform and CustomerCore give insurers a clear window into customer needs and can enable custom automation. The open architecture allows access to third-party data sources, that, for example, inform carriers of major life events (marriages, home purchases, etc.) before the customer does. Insurance providers can then create workflows to generate relevant upsell and cross-sell offers, strengthening trust and loyalty.

EIS Platform Overview

Stay up-to-date on the latest news from EIS.

Tower Insurance Case Study