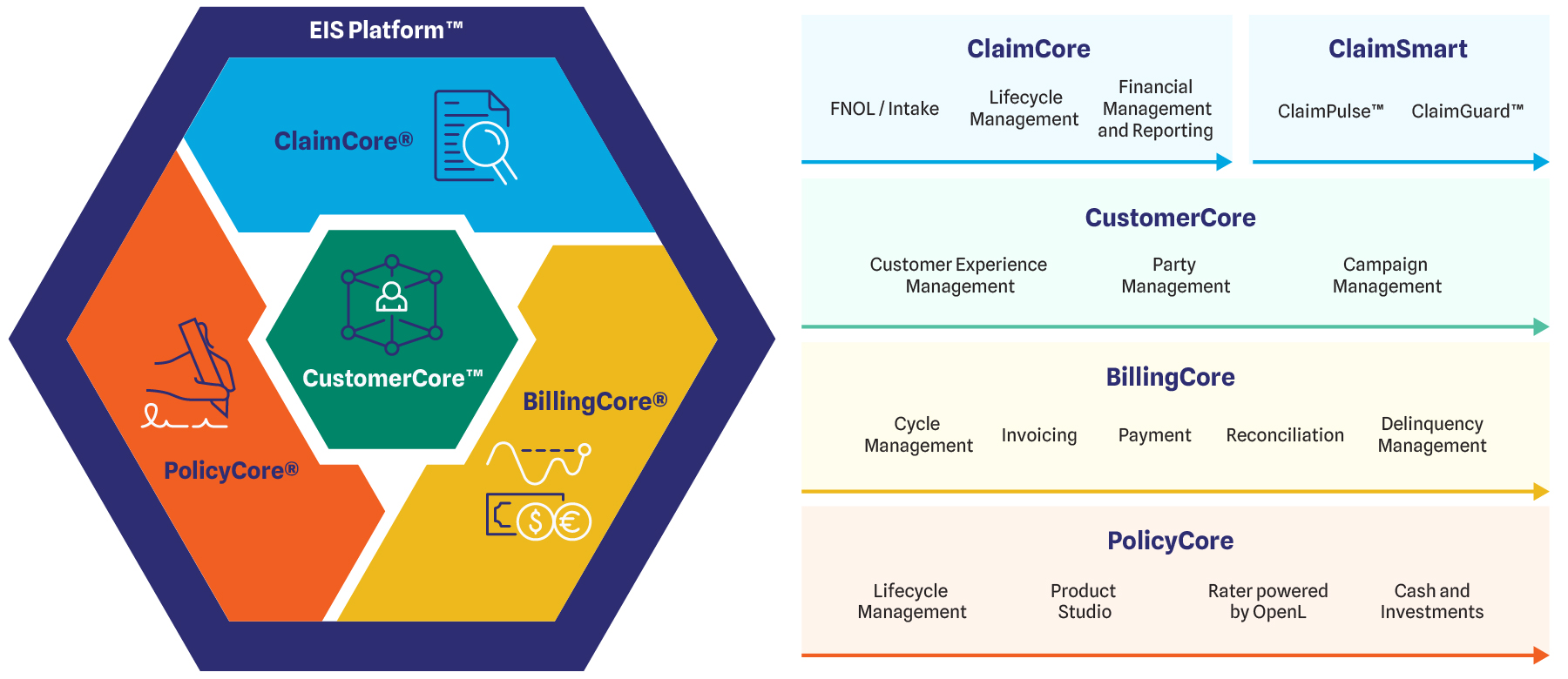

With EIS Platform™ as our base, and CustomerCore™ our central record-keeper, everything involved in policy administration, billing management, and claims management integrates seamlessly and efficiently into one cohesive customer-centric experience for both the customer and the insurer. Our open, API-rich, event-driven architecture helps you do things that insurers of the past could only dream of.

Watch our video about how the fictional Galaxias Insurance took advantage of superior architecture to future-proof their business model: